Debt Consolidation Loans to Get Rid of Credit Card Debt - Should I Consider Bank of America?

"The best debt solution for everyone will depend on their unique financial circumstances. There is no one solution that can always be the very best for everyone. Your starting place is always to know the main debt solutions available and what circumstances they're best fitting for. You will then be able to see which choice is apt to be the best fit on your own situation.

I would like to get consolidation loans off the beaten track to start with, as this is the right off the bat people consider when these are searching for a solution of debt. It must be declared there aren't that lots of situations where borrowing more cash will ultimately leave you in a very better position. There are some circumstances in the event it can be the most effective option, these are much less expensive frequent than many people imagine.

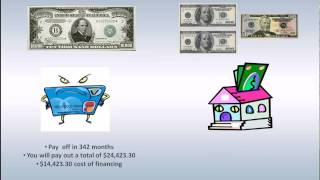

The attraction of such loans may be the prospect of lower monthly premiums and just one payment to make, but when you are not careful you can pay an increased price for this short pinnacleonefunding.com term gain. The problem is that the new loan indicates you are purchasing your finances more than a a lot longer period, with the result that when the money is paid off they have set you back a great deal more than you originally owed on the old debts.

A much better prospect is likely to be a debt relief plan. This too can often be called debt consolidation reduction, specifically in the US, nevertheless it does not involve obtaining any new loans. Debt management is how a business create a repayment schedule to suit your needs, and that means you only make a single reduced payment on the debt solution company rather than to all your creditors. The payments on such a plan are lower for the reason that company negotiates together with your creditors to setup more favourable terms to the repayment of your finances. You usually end up paying less in interest as well as other charges, which means that your particular monthly outgoings are reduced.

This is generally viewed as the most effective debt solution for substantial numbers of personal debt, which is a not so formal arrangement which can be modified in case your circumstances change. Unsecured debts include any type of debts that don't use a legal binding to your valuable asset as security. Mortgages are not unsecured because they may be associated with your house, which can be repossessed in case you default on payments.

To be regarded for a debt relief plan you will need to possess a revenue stream that is certainly sufficient to cover your normal monthly outgoings and also the payment necessary for plan. Some people see that their everything is so that they simply don't have enough spare money for that necessary payments. For these people the top debt option is likely to be debt consolidation if these are in the US or perhaps an Individual Voluntary Arrangement (IVA) if these are in the UK.

Debt coverage is quite different to managing debt in this the key idea is to get agreement to write down off as much of one's debt as is possible, as opposed to wanting to repay it all. This is a process undertaken by debt negotiation companies who may have skilled negotiators working on your own behalf to agree deals with creditors. The incentive they will use to steer creditors to stay is the agreed settlement amount is going to be paid inside a one time payment. Their other incentive is while confronting people facing possible bankruptcy, they realize that gaining access to least section of the a reimbursement can be quite a more attractive prospect than perhaps getting almost nothing if they go bankrupt.

To make it possible to repay the settlement amounts you simply must stop paying creditors when you begin on a debt negotiation program, and set money instead into another holding account. This can then build up on the time period of the negotiations and be used to generate settlement payments as terms are agreed.

The other option I mentioned for UK residents is an IVA, which to any or all intents and purposes does the identical job as credit card debt settlement. This is a formal agreement only obtainable in the UK, whereby you make a fixed payment amount that goes towards your debts, but at the end of the agreement your remaining debts are written off.

Both credit card debt settlement and IVAs are prepared for people in much more severe situations who are not managing to take care of their debt repayment and who might otherwise face bankruptcy. Debt management is for people who will be struggling with substantial debt but do possess a steady income. All of these choices only suitable for unsecured debts, for example money owed to card companies or financial institutions and the most effective debt solution in your case http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/https://www.nerdwallet.com/blog/loans/payoff-debt-consolidation-personal-loan-review/ will depend which situation you happen to be in. Whichever option you might need, you will have to take the appropriate steps to find the most effective debt solution company you can easlily to function on the behalf.

Taking care about how we pick a debt company is absolutely vital since there are some who are not really good and others who will be verging on being scam artists. It is easy to avoid such companies by making use of only organisations which were recommended following thorough research.& If you begin with a directory of the top debt solution companies, known to be one of the most reputable and ethical, it is possible to then connect with three or higher ones, which will give you the opportunity to create a comparison. Applying on the web is very simple and puts you under no obligation to proceed.| It has happened to millions of us. Life is going good. You feel invincible. You allow your credit card debt to develop beyond what you ought to. Then things have a turn for your worse and you realize you can don't afford to pay for your obligations. And now you feel fat loss out. I understand what you really are feeling. I have been through it as well. Just know this - there are methods out. Life is not over. Money is not everything. Take a deep breath and resolve to find the right path to financial independence. Here are 5 options to getting debt relief:

1) Debt Stacking. You may have also heard it referred to as Debt Snowball. This option is more suited to the individual/couple that is certainly considering getting out of debt but is not necessarily in dire straits. The concept is rather simple but requires discipline. It is a basic accounting principle. List your debts with a piece of paper. Now order those debts from highest monthly interest to lowest (a different is usually to order the money you owe from lowest balance to highest). Next to each account write the minimum payment required. Now determine how a lot more you'll be able to afford to spend towards your debts across the sum of the minimum payments. Now continue paying the money you owe but position the entire additional amount that you have budgeted to pay towards the debt towards the debt near the top of your list and pay the minimum towards the rest. Continue to do so before you pay back the initial debt. Now consider the entire amount you'd previously paid towards that 1st debt and place that amount for the second. Continue this method down the list until your financial situation are entirely paid off. It may sound simple, nevertheless the concept is incredibly powerful. By using this option you'll take years from the time it would take to pay off your debt and save you thousands in interest.

2) Debt Consolidation. This is an option in places you take all of the money you owe and combine them into one loan using a lower rate of interest. This option has it's advantages as well as disadvantages. The advantage is always that this will typically not hurt your credit and if disciplined, allow you to spend off the debt sooner. The disadvantages are that 1) we're all not discipline enough and quite often just go out and borrow more compounding the issue, and a pair of) some of the loan consolidation is secured against your house. This means that you will probably convert personal debt (ie cards, medical bills, etc) that is a lot more easily discharged through bankruptcy or settled through debt settlement into secured debt that puts your individual home at an increased risk in the event you default.

3) Debt Management Plan. Debt Management typically involves a third-party company (usually non-profit) negotiating less interest and/or longer payment term on your credit card debt. This helps one to decrease your monthly payment. The company is paid from your creditors directly for their services. The advantages to this particular option is you are able to pay for off the debt without excessive creditor harassment or devoid of the risk of getting sued for non-payment of debt. The disadvantage is always that it will typically be more difficult to cover your debts off, hurt your credit rating, if you miss a payment the creditors frequently have the legal right to revert back to the old terms of the agreement and also the company letting you often is beholden with their boss - your creditors.

4) Debt Settlement. Debt Settlement involves you (or perhaps a third-party company you hire) settling your debt for an amount 40-60% less than your balance. With Debt Settlement, you end payment your creditors and begin putting away funds in a settlement account you own to with creditors. As the account grows, creditors will likely be settled individually. The advantages to debt negotiation are that you simply typically pay off the debt in a shorter length of time and pay under your initial principal. You also maintain control of your settlement since funds are put into money account of you instead of sending these phones your creditors. The disadvantages are that it's going to hurt your credit (since creditors typically is not going to settle and soon you are near least six months late), that you may have to cope with creditors' collection practices, and, should you hire a company that may help you, you may have to spend that company from 10-20% of your credit card debt amount.

5) Bankruptcy, Chapter 7 or 13. I will not likely get too thorough here because this choice is legally complicated. Basically a chapter 7 requires the court liquidating your assets to pay your creditors. Chapter 7 permits you to definitely exempt some personal property and thus depending on the situation this might be the most suitable choice to suit your needs or will be the worst option. A Chapter 13 requires the court ordering your creditors to accept a court generated repayment plan.

It is very important to get legal counsel prior to choosing these options and especially prior to contemplating bankruptcy. Being deep in Debt can seem to be being a scary thing with no result in sight. However, you will find options along with your not by yourself. Seek help and place it in perspective. Good luck!

"